Creating Silver Linings through M&A During a Downturn Part Three

Transformational Investing for Success

In this article, Carleton McKenna analyzes the silver linings that help businesses come out of recessionary periods with some of their highest growth rates. We will then discuss what transformative investment opportunities may exist in the current environment to help position companies to achieve strong growth coming out of the COVID-19 crisis.

One of the most successful businesses during the ‘08/’09 recession is unsurprisingly generating media headlines again during the current COVID-19 lockdown. Streaming movies from Oscar nominees and fictional pandemics to the country’s most recent obsession, Tiger King, Netflix has experienced a strong rise in stock as quarantined consumers are utilizing substantial portions of their at-home time (and bandwidth) watching popular movies and TV shows.

Strategic investment (or lack thereof) in the present will shape the next 3 years.

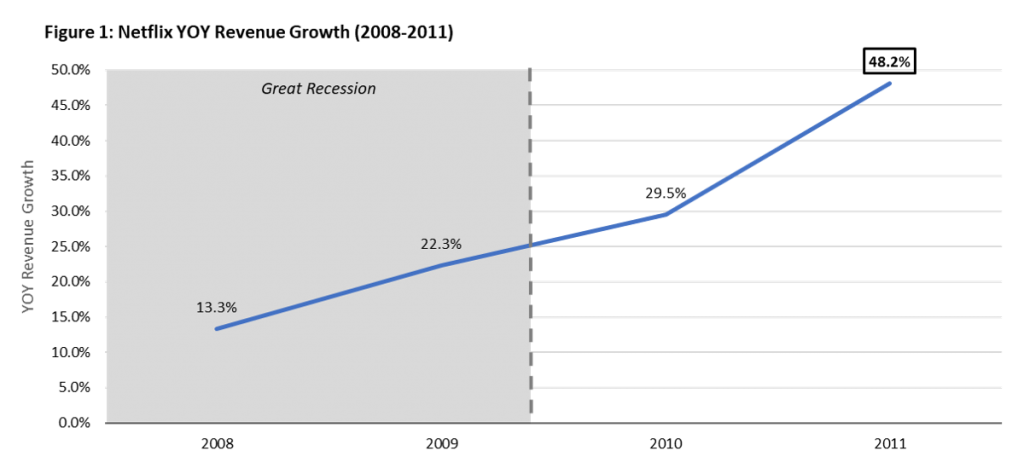

Netflix gained 3 million subscribers in 2009, the peak of the Great Recession. As new video-on-demand services became available though Comcast and Apple, Netflix identified opportunity to release its own tv/movie streaming plan that would provide an “unlimited” amount of entertainment. Despite a mortgage crisis, major company bankruptcies and a highly depressed stock market, Netflix did not halt its growth plans and made one of the riskiest moves in its history. In 2008, after spending years of development on the Netflix Player (a digital media player and hardware for at-home streaming), the Company decided to spin the project into a separate company known as Roku. Netflix felt producing its own hardware would conflict with its device maker partnerships (e.g. Sony, Samsung, LG) and decided to focus its business model on licensing (digital content) and related services. After multiple capital investments into Roku and releasing the new Netflix streaming plan with Roku’s partnership, the Company grew with their customer service reputation and high-quality brand. Netflix achieved its highest annual revenue growth rate just two years after the Great Recession.

Economic Disruption may trigger the “New,” but Industry Disruption creates the “Norm.”

Innovators are flexible and adaptable by nature, even when they are unsure as to how a cycle will turn out. Not only was this demonstrated by Netflix in their risky spin-off and streaming launch decision, but we see this innovation and adaptability daily in the current COVID-19 environment. It is remarkable how quickly these innovators — from tech, connectivity and healthcare companies to the universes of government, academia and philanthropy — are collaborating to advance medical treatments and healthcare delivery to address the immediate challenges due to COVID-19. This sense of urgency to find solutions now will likely set the stage for future rapid innovation. Furthermore, when the COVID-19 crisis ends, companies will be able to apply these new collaborative models to other multi-stakeholder problems.

As we consider how quickly this pandemic has shaped our daily routines to include telemedicine, distance learning and new habits of professional and personal communication, we can likely expect a catalyst of (i) long-term investment in various remote technologies and systems, and (ii) the formation of partnerships as a means for quicker and lower-risk adoption. Companies who are proactive and strategic in incorporating these innovations into their business models are more likely to find success coming out of the current economic downturn. Companies who choose to delay these investments and partnerships could find themselves competing in a “New Normal” with a less-relevant business model.

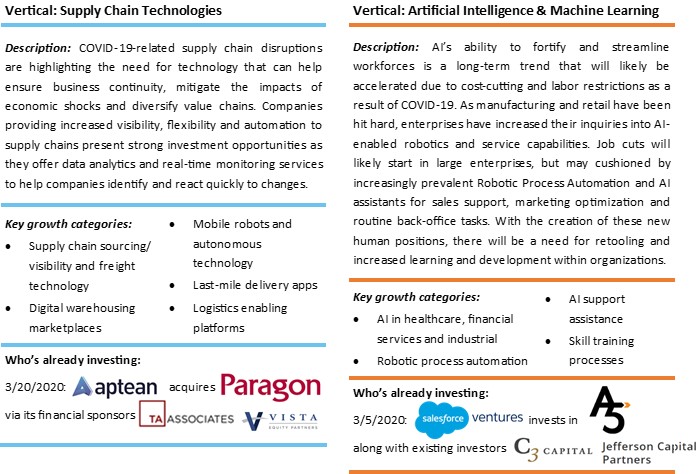

The following emerging technology verticals should become useful in creating silver linings via highly valuable growth across many industries heading into a post COVID-19 landscape:

“There is no such thing as luck, merely opportunity meeting preparedness.” — George S. Patton Jr.

While we can estimate the technological investments and actions that may help a company exit the COVID-19 crisis on a positive trajectory, there is no certainty around the long-term economic impact of this pandemic. Our firm advises our clients and prospects with evidence and experience-based research, strategies and best practices that are relevant to businesses navigating the current environment. As demonstrated throughout the Creating Silver Linings Through M&A During a Downturn series, there are various strategic and financial approaches that businesses should consider during these challenging economic times to support future growth:

- The unique opportunities associated with large amounts of available capital, both private equity dry powder and corporate cash, in combination with quickly changing consumer trends;

- The ability to use divestitures to refocus management teams and operations on the true core of your business, while also improving financial positions; and

- Proactively analyzing and investing in the transformational technologies that are anticipated to re-shape various industries following this economic downturn.

Successful companies like Netflix did not thrive after the Great Recession due to a matter of luck—they stayed true to their core competencies and made strategic moves to enhance their position in a post-recessionary environment.

At Carleton McKenna, we are here to help the middle market business owners of 2020 to find and create their own Silver Linings. If you are a business owner (or know one) looking to sell, raise capital, make acquisitions, or simply gain a better understanding of what strategic alternatives may exist for you, we can help.